- MARKETS WITH MAY

- Posts

- UBER: Down 11% On A Pretty Great Quarter

UBER: Down 11% On A Pretty Great Quarter

Disclosure: The author owns securities in the referenced company or companies. This is not financial advice or a recommendation, and not a substitute for due diligence.

UBER is down 11% on a pretty great quarter. I’m nitpicking, but management, your earnings release formatting is a real pain in the a$$.

Rev +20%, adj op income +169%, adj net income +238%

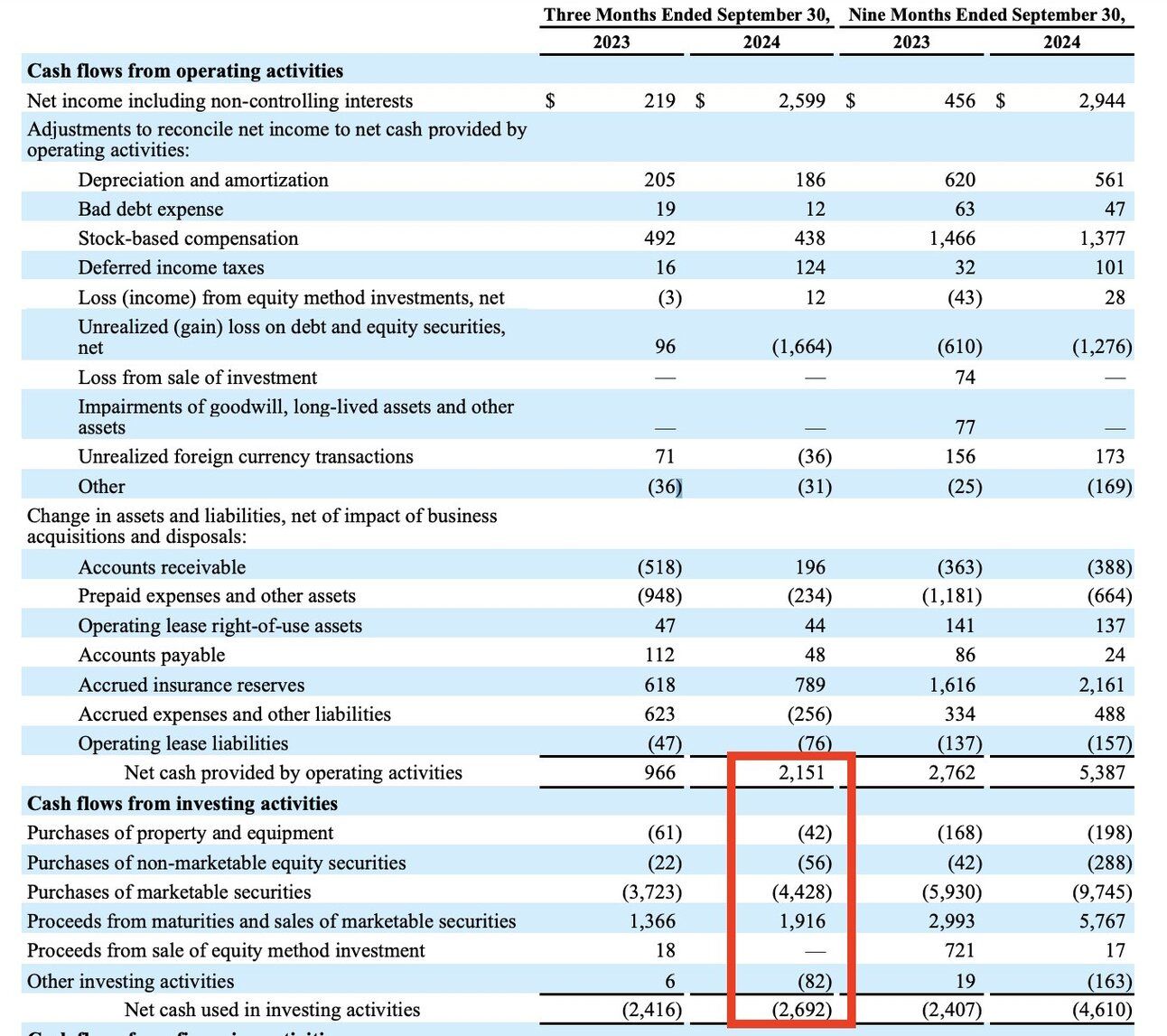

This was all on lower operating expenses. The adjustment removes the mark-to-market unrealized gains on equity investment, which is a huge payday right now, but who knows in the future.

You are actually throwing off a ton of cash to buy stock back. Their authorization is only $375M though.

Valuation is a tough one. Not because it’s high, but because it’s not straightforward how to think about it. They are guiding to Q4 EBITDA of $1.8M. If I remove the acquisitions, I get $984M in Q3 (not crediting adjustments) and $1.5B YTD.

So, you’re saying a double from Q3 to Q4? And a trailing 12-month EBITDA of $5.5B on $171B of enterprise value or 31x trailing EV/EBITDA without giving you credit for your makeshift private equity stuff?

That’s actually not so expensive.

Final thing… Management, if you could print an adjusted number for earnings going forward I’d be stoked. It’s really annoying when you don’t do that. You’re a real company in the S&P 500 company now. We need to see your earnings without this other income nonsense. K, thx, byyyeeee!

Original tweet: https://x.com/marketswithmay/status/1852029130503504186

Reply